#Fundbox invoice factoring full#

The purpose of this determination is to prevent firms from using invoice factoring to transfer income overseas or engage in tax avoidance or tax evasion regarding the use of invoicing.įor more information, read our full article about taxes and factoring. The IRS considers several factors in determining whether any factored receivables qualify as taxable. For business owners, it can be difficult to identify whether factored receivables are subject to taxes payable to the federal government. But how does factoring fit into the tax system in the United States? This relationship is somewhat complex. So, invoice factoring presents many potential advantages for a company. A completed factoring application – Apply NowĪre factored receivables subject to taxes?.In order to qualify for factoring, your company will need to have the following items: How do companies qualify for invoice factoring? Read more about all of the advantages and disadvantages of factoring and the invoice factoring approval process. Hidden costs and fees from bad factoring companies.Reduced profit margins for your business.

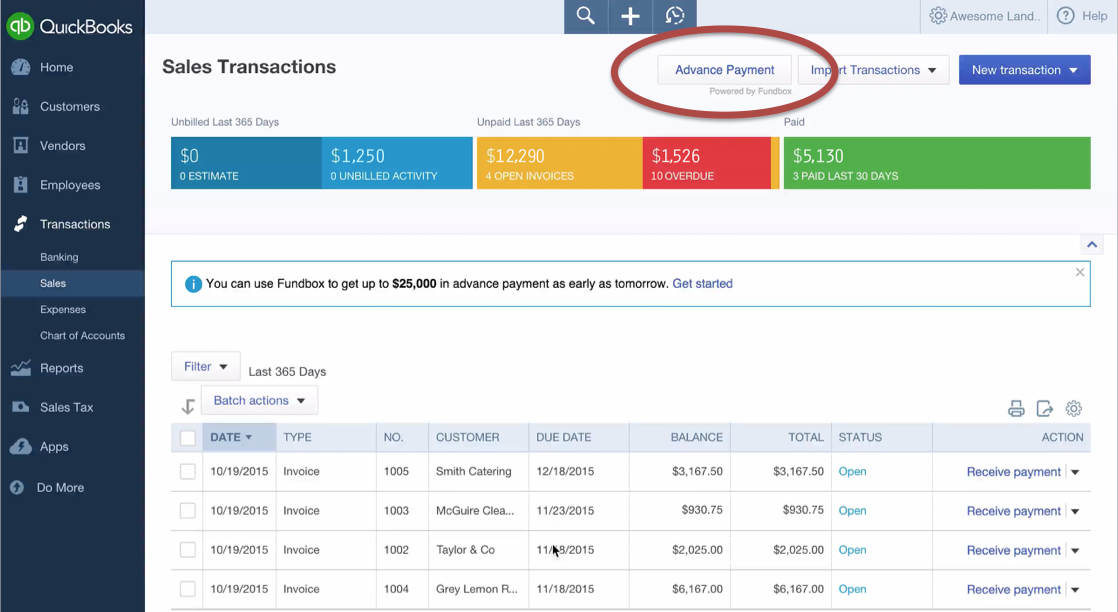

Easier and faster approval than traditional bank lending.Immediate access to cash for your business.Here, we’ll break down the the pros and cons so you can see the full picture. While there are many positives to invoice factoring, there are also downsides, depending on the nature of your small business and the factoring partner you choose to work with. Invoice factoring example: Invoice Face Value The remaining 10-20% of the invoice value is released to the Seller, minus a small Factoring fee (for example, on Day 26).

That likely prevents you from investing in growth opportunities or maintaining day-to-day operations that keep everything on track. These long payment cycles put many small business owners in a constant cash crunch, making it hard to keep up with critical expenses like payroll, utilities or inventory. Most invoices are set to payment terms of 30 to 90 days, meaning that from the day an invoice is sent to your customer, you’re unlikely to see that money for at least a month, if not longer. Waiting for customers to pay their outstanding invoices? You’re not alone.

0 kommentar(er)

0 kommentar(er)